All Categories

Featured

Table of Contents

These attributes can vary from company-to-company, so make certain to explore your annuity's survivor benefit functions. There are numerous benefits. 1. A MYGA can suggest reduced tax obligations than a CD. With a CD, the interest you earn is taxable when you earn it, despite the fact that you do not obtain it until the CD grows.

So at least, you pay taxes later on, as opposed to faster. Not only that, but the intensifying rate of interest will be based on an amount that has not already been tired. 2. Your recipients will certainly get the full account worth since the date you dieand no surrender fees will certainly be subtracted.

Your beneficiaries can choose either to receive the payout in a round figure, or in a collection of revenue settlements. 3. Usually, when a person passes away, even if he left a will, a court decides who obtains what from the estate as often family members will suggest about what the will certainly ways.

With a multi-year set annuity, the proprietor has actually clearly marked a recipient, so no probate is called for. If you contribute to an IRA or a 401(k) plan, you receive tax deferral on the incomes, just like a MYGA.

Best Annuities To Purchase

Those products already use tax obligation deferment. MYGAs are excellent for people who desire to stay clear of the dangers of market changes, and want a taken care of return and tax obligation deferral.

When you pick one, the rate of interest will be fixed and ensured for the term you choose. The insurer spends it, normally in excellent quality long-term bonds, to money your future repayments under the annuity. That's since bonds are rather secure. But they can additionally purchase stocks. Bear in mind, the insurer is counting not simply on your private settlement to money your annuity.

These compensations are constructed right into the purchase cost, so there are no hidden charges in the MYGA contract. That suggests purchasing multiple annuities with staggered terms.

Companies That Offer Annuity Retirement And Investment Products

If you opened up MYGAs of 3-, 4-, 5- and 6-year terms, you would have an account growing each year after 3 years (state farm fixed annuities). At the end of the term, your cash might be taken out or taken into a new annuity-- with good luck, at a higher price. You can likewise use MYGAs in ladders with fixed-indexed annuities, a technique that looks for to maximize return while additionally shielding principal

As you compare and contrast images offered by different insurance provider, consider each of the areas noted over when making your decision. Understanding agreement terms as well as each annuity's benefits and downsides will allow you to make the very best decision for your economic circumstance. Believe thoroughly regarding the term.

Annuity Growth

If interest prices have climbed, you might want to secure them in for a longer term. Throughout this time, you can get all of your money back.

The business you buy your multi-year ensured annuity with agrees to pay you a fixed rate of interest on your premium amount for your picked time period. You'll get interest credited often, and at the end of the term, you either can restore your annuity at an upgraded rate, leave the cash at a fixed account price, choose a negotiation option, or withdraw your funds.

Companies That Sell Annuities

Considering that a MYGA uses a set passion price that's ensured for the agreement's term, it can give you with a foreseeable return. With rates that are set by agreement for a particular number of years, MYGAs aren't subject to market changes like other financial investments.

Annuities generally have fines for early withdrawal or surrender, which can restrict your capability to access your cash without fees. MYGAs might have lower returns than stocks or common funds, which can have greater returns over the long term. Annuities usually have surrender fees and administrative costs.

MVA is an adjustmenteither positive or negativeto the built up worth if you make a partial surrender above the free amount or fully surrender your agreement during the abandonment cost period. Rising cost of living threat. Because MYGAs supply a set rate of return, they might not keep speed with inflation gradually. Not insured by FDIC.

Fixed Annuities Insured

MYGA prices can transform commonly based on the economic situation, but they're typically higher than what you would certainly make on a financial savings account. Need a refresher on the four fundamental types of annuities? Discover much more just how annuities can guarantee an income in retired life that you can not outlast.

If your MYGA has market worth modification stipulation and you make a withdrawal prior to the term mores than, the firm can change the MYGA's abandonment value based upon changes in passion rates - best retirement annuity plans. If rates have actually increased considering that you acquired the annuity, your abandonment worth might lower to account for the higher rates of interest environment

Annuities with an ROP stipulation typically have reduced surefire passion prices to balance out the business's prospective risk of having to return the premium. Not all MYGAs have an MVA or an ROP. Conditions depend upon the business and the contract. At the end of the MYGA duration you've selected, you have 3 options: If having actually an ensured rate of interest rate for a set variety of years still lines up with your financial approach, you merely can renew for one more MYGA term, either the very same or a various one (if offered).

With some MYGAs, if you're uncertain what to do with the money at the term's end, you don't have to do anything. The gathered worth of your MYGA will relocate into a repaired account with a sustainable one-year rate of interest price determined by the business - what age can you buy an annuity. You can leave it there till you pick your following step

While both deal guaranteed prices of return, MYGAs usually use a greater rates of interest than CDs. MYGAs grow tax obligation deferred while CDs are exhausted as earnings each year. Annuities expand tax obligation deferred, so you do not owe revenue tax on the revenues until you withdraw them. This allows your revenues to compound over the term of your MYGA.

This decreases the capacity for CDs to gain from long-lasting substance interest. Both MYGAs and CDs generally have very early withdrawal charges that may influence short-term liquidity. With MYGAs, abandonment costs might apply, depending on the kind of MYGA you choose. So, you might not just shed interest, yet additionally principalthe money you originally added to the MYGA.

Best 5 Year Fixed Annuity Rates

This implies you might lose interest but not the primary amount contributed to the CD.Their conservative nature typically allures extra to individuals who are approaching or already in retired life. However they could not be best for everyone. A might be best for you if you desire to: Make the most of a guaranteed price and lock it in for an amount of time.

Take advantage of tax-deferred incomes growth. Have the option to pick a negotiation alternative for a guaranteed stream of earnings that can last as long as you live. As with any kind of financial savings car, it is necessary to very carefully examine the conditions of the product and seek advice from to identify if it's a wise option for attaining your individual needs and objectives.

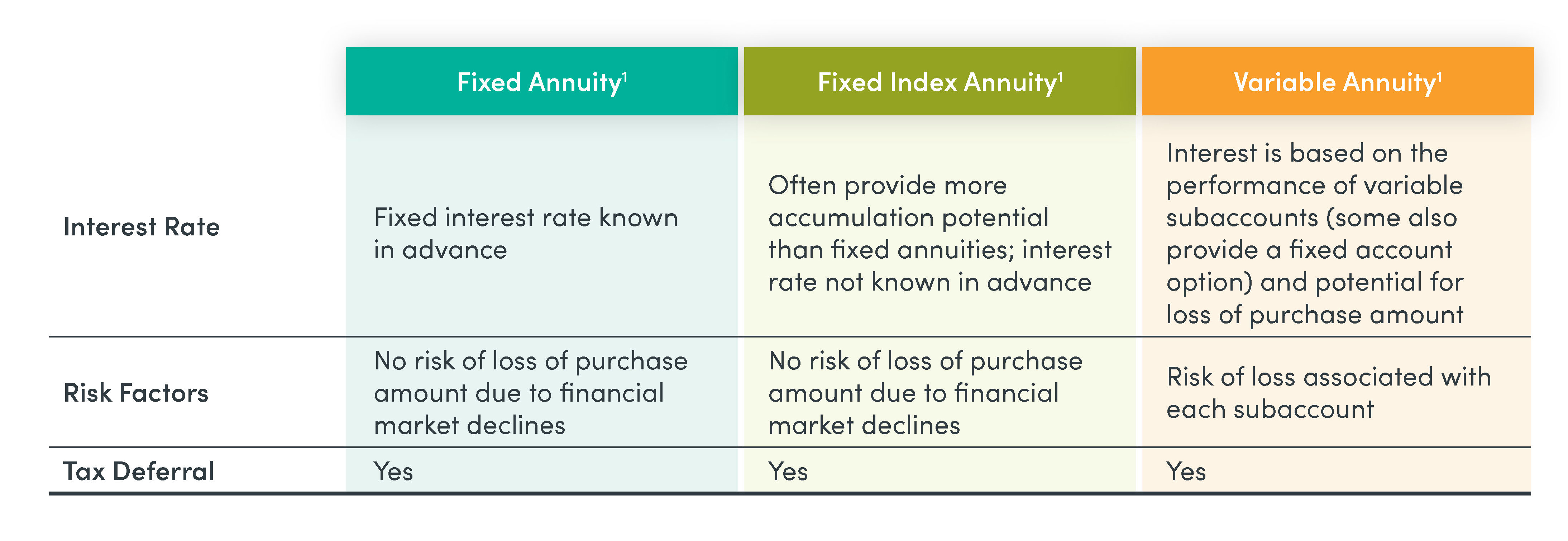

1All guarantees consisting of the survivor benefit settlements are reliant upon the claims paying capacity of the issuing company and do not put on the financial investment efficiency of the underlying funds in the variable annuity. Possessions in the hidden funds go through market threats and might rise and fall in value. Variable annuities and their hidden variable financial investment options are sold by program just.

Annuity Settlement Options Explained

This and various other info are had in the syllabus or recap prospectus, if readily available, which may be gotten from your investment expert. Please review it before you spend or send out cash. 2 Scores go through transform and do not put on the underlying financial investment alternatives of variable products. 3 Existing tax obligation regulation undergoes analysis and legislative adjustment.

Entities or individuals distributing this details are not authorized to offer tax obligation or lawful recommendations. People are encouraged to look for specific guidance from their personal tax or legal advice. 4 , Just How Much Do Annuities Pay? 2023This material is intended for general public usage. By giving this web content, The Guardian Life Insurance Policy Firm of America, The Guardian Insurance Coverage & Annuity Firm, Inc .

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About What Is A Variable Annuity Vs A Fixed Annuity Defining Fixed Index Annuity Vs Variable Annuity Pros and Cons of

Exploring the Basics of Retirement Options Key Insights on Fixed Annuity Or Variable Annuity Defining Indexed Annuity Vs Fixed Annuity Advantages and Disadvantages of Different Retirement Plans Why Fi

Breaking Down Your Investment Choices A Closer Look at Fixed Vs Variable Annuity Breaking Down the Basics of Fixed Indexed Annuity Vs Market-variable Annuity Benefits of Choosing the Right Financial P

More

Latest Posts